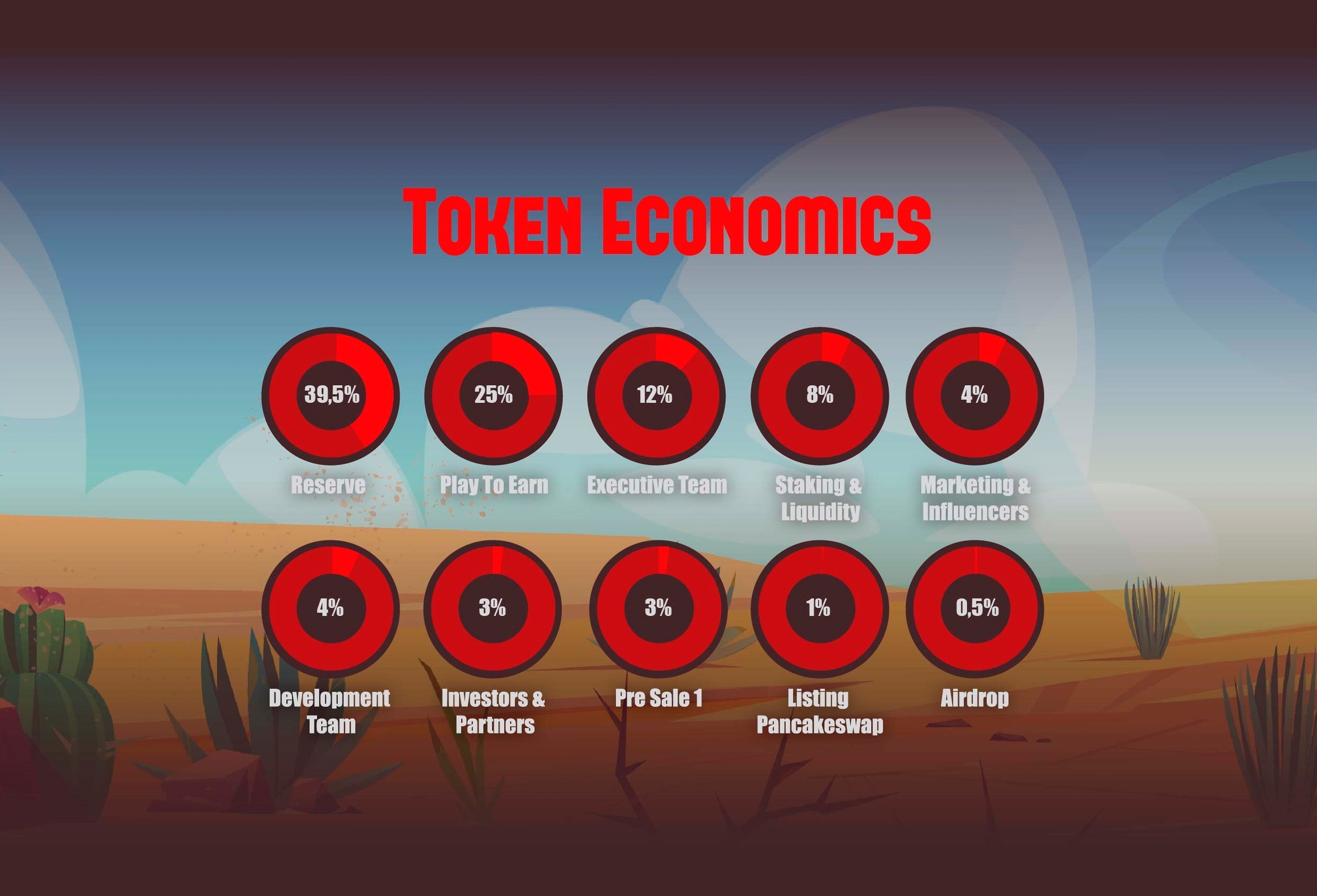

🪙Token Economics

MTZ TOKEN BASIC INFORMATION

| MTZ | Amount | Percentage | Time |

|---|---|---|---|

Total Supply | 300.000.000 | 100% | Q1 2022 |

Airdrop | 1.500.000,00 | 0,5% | Q1 2022 |

Pre Sale | 9.000.000,00 | 3% | Q1 2022 and Q2 2022 |

Listing Pancakeswap | 3.000.000,00 | 1% | Q2 2022 |

Play to Earn | 75.000.000,00 | 25% | Issuance starts in Q2 2022. The number of Tokens in this Rewards Pool is not fixed, it will be continuously added by the company to reward players |

Staking & Liquidity | 24.000.000,00 | 8% | Issuance starts in Q3 2022. |

Investors & Partners | 9.000.000,00 | 3% | |

Executive Team | 36.000.000,00 | 12% | Vest 0.5% monthly on a straight-line basis over 2 years |

Development Team | 12.000.000,00 | 4% | Vest 0.5% monthly on a straight-line basis over 2 years |

Marketing & Influencers | 12.000.000,00 | 4% | Pool Liquidity |

Reserves - Blocked 1 year (audited) | 118.500.000,00 | 39,5% | Blocked for 1 year, so collect linearly for 2 years |

Explanation:

Airdrop (0,5%) - Distributed in 3 different rounds during the project.

Pre Sale (3%) - Pre-sales take place in 4 stages, in the first stage the MTZ will be sold at $0.70, in the second stage $0.80, in the third stage $0.90 and in the last stage it will be sold at $1.00. The pre-sale follows the open sale model with a limited number of tokens and participants, being carried out on its own platform and accessed by metamask.

Listing Pancake Swap (1%): MTZ initial listing in pancake swap is valued at $1.00 per token. The total to be released is 3,000,000,00 MTZ. Opening the market price.

Development team (4%) - Recurring withdrawals of 0.5% linear, the total remaining blocked for 2 years.

Investors & Partner (3%) -Sales and Strategic Partnerships for the game market.

Executive Team (12%) - Recurring withdrawals of 0.5% linear, the total remaining blocked for 2 years.

Stake & Liquidity (8%) - Liquidity fund for the game, and stake rewards redemption.

Marketing & Influencers (4%) - Initial marketing fund, with 10% of re-entry being reapplied to this fund.

Play-to-earn (25%) - Fund for the payment of rewards, applying the outflow and re-entry of dividends, always balancing the fund up to 30%.

Reserves (39%) - Reserve fund blocks 39% for forced liquidity plan, and only after 1 year of linear distribution for the next 2 years.

Last updated